Eurex Clearing Prisma is a margin calculation method that focuses on the portfolio. This enables portfolio margining within an asset class, as well as cross margining across asset classes, e.g. between listed interest rate derivatives and OTC swaps cleared by Eurex Clearing.

The methodology is based on the consideration of the overall portfolio of each Clearing Member. In contrast to a product-based approach, this has the advantage of taking hedging and cross-correlation effects into account by determining the margin requirement at portfolio level. The risks are calculated across the markets and trading venues cleared by Eurex Clearing for products that have similar risk characteristics. The use of cross-product scenarios allows for a consistent consideration of portfolio correlations and diversification effects.

The model components have been designed to ensure that the risk calculation is based on the standards of accuracy and stability, thus ensuring that the risk model can withstand shocks and changes in the financial markets and adapt dynamically to changes in the risk environment.

The core features of Eurex Clearing Prisma benefit Clearing Members, their customers and the clearing house equally:

High capital efficiency: Portfolio-based approach allows the consideration of portfolio correlations and diversification effects within listed and between listed and OTC transactions

High accuracy: Cross-product risk factor scenarios allow for the accurate and consistent determination of portfolio correlation and diversification effects.

Robustness: Model components are designed with stability and precision in mind in order to determine appropriate margin requirements in all market situations.

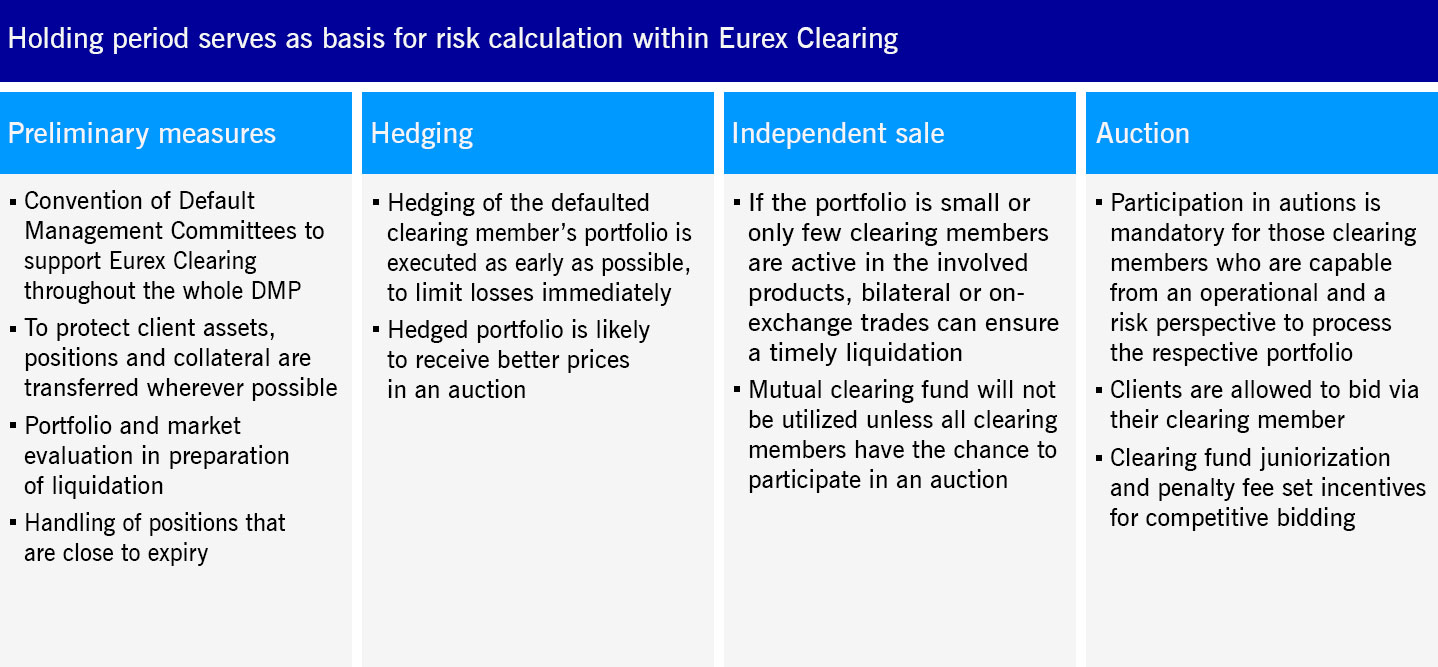

Overarching framework: Consistent risk and default management process for listed and OTC products