Service Navigation

History of the Frankfurt Stock Exchange

History of the Frankfurt Stock Exchange

- Fairs, coins and bills of exchange: 11th - 17th century

- Patricians, princes and commodity markets: 18th - 19th century

- Wars, reconstruction, the computer age and cross-border growth: 20th century

Wars, reconstruction, the computer age and cross-border growth: 20th century

The internationally oriented FWB® Frankfurter Wertpapierbörse (the Frankfurt Stock Exchange) was very hard hit by World War I and its consequences. Foreign shares and bonds were sold by German investors out of fear of instrumentalisation by the warring states; freed up capital was invested mostly in government bonds. By the end of the war, all foreign securities had disappeared from German exchange lists, as a result of which Frankfurt lost its standing as an international stock exchange. By the end of the war, the international contacts of the Frankfurt Stock Exchange had been lost. Inflation set in and reached its first peak in 1923. The stock exchange saw unprecedented losses in securities of monetary value. By contrast, demand for stocks as speculation objects sharply increased. In October 1929, however, stock exchange prices fell dramatically and 25 October 1929 made history as “Black Friday”. The world economic crisis ruled the following years. The economy only began to restabilise in 1932.

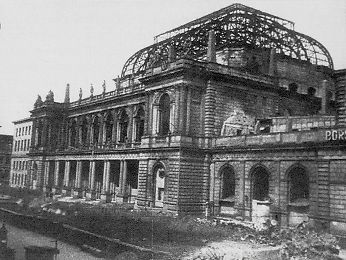

Damaged Stock Exchange Building 1944

© Historisches Museum Frankfurt am Main

Following the collapse of the Nazi regime in 1945, the exchange initially remained closed for six months. It was reopened in September 1945 under the protectorate of the US military government as one of the first German stock exchanges.

It was only following the currency reform of 1948 and the growing consolidation of the German economy that the Frankfurt Stock Exchange gradually recovered its old significance. In 1949 the Frankfurt stock exchange official trading starts up again. In the same year, the securities and clearing deposit bank Frankfurter Kassenverein is founded as a stock corporation, whose most significant task is the necessary settlement and clearance of securities after the war.

In 1953 four currency exchanges are opened, for the US Dollar, Canadian dollar, Swiss franc and currencies of the European Payments Union. Beginning in 1956, the purchase of foreign securities was again permitted in Germany. Frankfurt was thus able to return to its tradition of international business and resume its leading position in Germany. The stock exchanges played an important role as capital intermediaries for the country's post-war reconstruction. Through their activity, they were also decisively involved in the subsequent 'economic miracle' in the 1950s and 1960s and in the Federal Republic of Germany's achievement in becoming a major economic force in the world.

The Main Trading Hall of the exchange building at Rahmhof (today’s Börsenplatz) in the centre of Frankfurt is reopened after rebuilding in 1957.

In 1969 the digital age arrives at the Frankfurter Wertpapierbörse. Traders can now process securities transactions electronically by BÖGA, a computer system to process stock exchange transactions One year after, in the next step exchange member firms are now able to interact with the exchange computer via telex.

Börsen-Daten-Zentrale GmbH (BDZ) is founded in 1970. As the data centre of the Frankfurt stock exchange, BDZ is one of the precursors of Deutsche Börse Systems AG. In the same year Deutscher Auslandskassenverein AG (AKV), one of the precursors of today’s Clearstream International S.A., is founded by the regional securities clearing and deposit banks.