Derivatives

Derivatives Protection against price and rate fluctuations

What is a derivative?

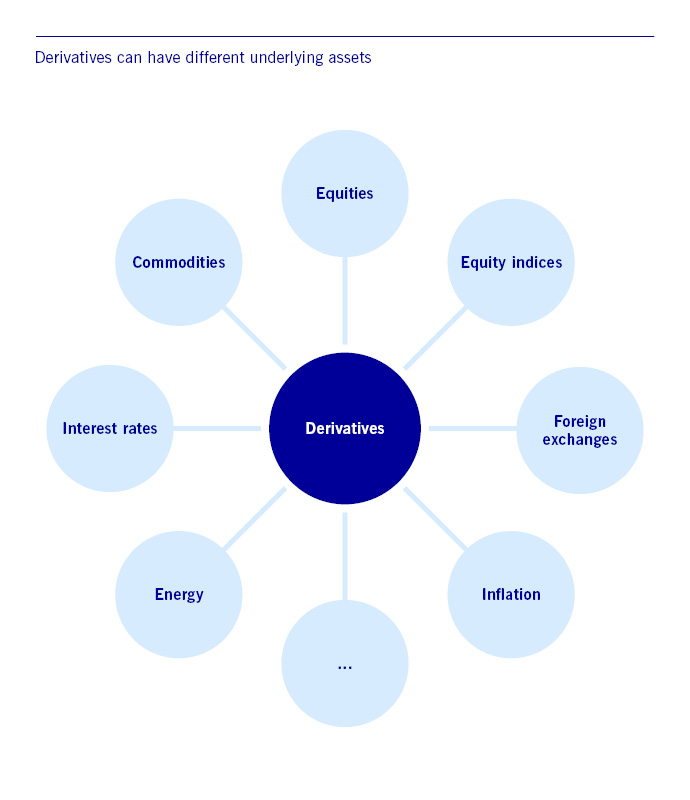

The word “derivative” comes from the Latin “derivare”, meaning “to draw off from”. A derivative is therefore a financial product whose price performance is derived from that of another financial product, termed the underlying product. An underlying may be another security such as a share or a bond. Thus, derivatives are indirect investments whose value depends on the product underlying them.

Derivatives trading can be used both for speculation and for risk hedging, e.g. against rate fluctuations. There are therefore a multitude of derivatives on a wide range of underlyings.

Derivatives may be structured as futures, options or swaps.

Why trade in derivatives?

A shareholder can use an option or a future on that share to hedge against changes in price. If the price of a share falls, for example, the investor is hedged against the fall in the price of that share. So, a derivative is a kind of financial protection. It is a financial instrument whose price and performance are determined by the fluctuations in or price expectations for other investments.

Due to their complexity, derivatives are traded by professional investors, who use them primarily as a precautionary measure against the sharp fluctuations in the price of shares and interest rate products on the financial markets. Companies, investment and pension funds, and the public sector also use derivatives as a (long-term) hedge instrument against the risk of interest and exchange rate fluctuations.

Eurex Exchange – architects of trusted markets

Via Eurex Frankfurt AG, Deutsche Börse operates the Eurex Exchange derivatives market – the largest derivatives exchange in Europe and the largest worldwide by open interest.

As Europe’s largest venue for futures trading, it offers a wide range of standardised options and futures. It counts almost 7,000 registered traders across 350 members in 33 countries connected to its platform. With trading volumes exceeding 1.7 billion contracts a year, Eurex Exchange is one of the preferred marketplaces for the global derivatives community.

Deutsche Börse Group

Headquartered in Frankfurt/Main, Deutsche Börse Group is one of the largest exchange organisations worldwide. It operates markets that provide inte¬gri¬ty, transparency and security for investors wishing to invest capital and for issuers wishing to raise capital. On these markets, institutional traders buy and sell shares, derivatives and other financial instruments in accordance with clear rules and under strict supervision.

Deutsche Börse Group is now more than just a trading venue or exchange – it is a provider of financial market infrastructure. Its business areas cover the entire financial market transaction process chain. This includes the provision of indices, data and analytical solutions as well as admission, trading and clearing. Additionally, it comprises services for funds, the settlement and custody of financial instruments as well as the management of collateral and liquidity. As a technology company, the Group develops state-of-the-art IT solutions and offers IT systems all over the world.