targeting-share-investments

Providing for old age by targeting share investments Low interest? No, thanks!

Even when interest rates are low, investors can build up a pot of assets by themselves. Attractive financial instruments, such as shares, exchange-traded funds (ETFs), and other investment funds, are worth considering as alternatives to a call account and allow investors to benefit from the successes achieved by high-growth companies.

There is a need to raise awareness of shares and other investment formats

In 2022, only 12.9 million people in Germany have invested in shares, equity funds or equity-based ETFs. That is around one in five of the population over the age of 14. Compared to 2021, the number of investors increased by 826,000 in 2022. The last time that the number of German investors were roughly at the same level were determined in 2001 (source: Deutsches Aktieninstitut).

Shares are profitable investments over the long term

Shares are securities that document ownership interests in a company, i.e. the owners of a share – the shareholders – hold an interest in the company’s share capital, either a percentage interest or an interest equal to the par value shown on the share. Shares are traded on securities exchanges. Here, too, supply and demand usually determine the value of a share.

Shares generally entail both opportunities and risks, as their quoted prices can rise or fall. Their price (or quoted price) is driven by expectations for a company’s profits. As investors have different expectations for companies’ future performance, supply and demand for a share rise and fall, causing share prices to rise and fall too.

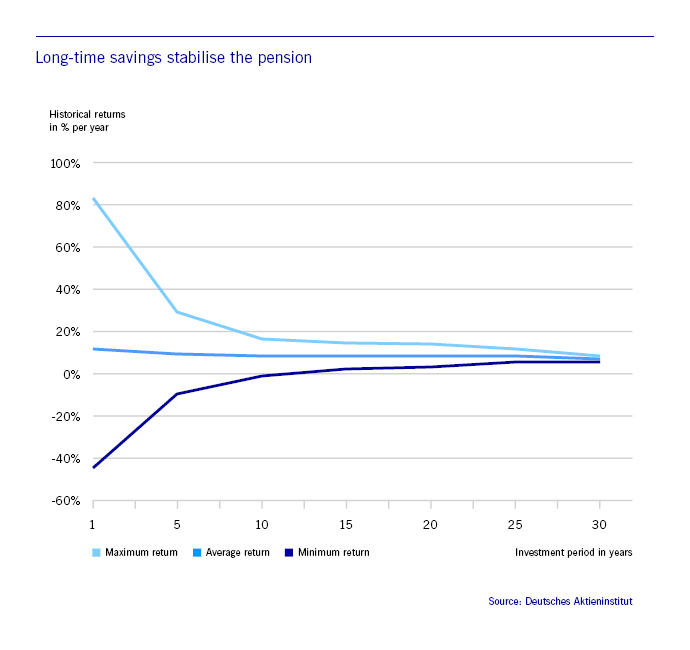

Although this means that share prices can fluctuate sharply over the short term, they have proven to be a profitable investment over the long term. Despite the financial crisis, investors in European shares earned an average return of 4.8 per cent a year between 2005 and 2015.

Those who invested in shares of the German stock index DAX, participated in the price development and dividends of the largest German stocks. For example, with an investment period of 20 years, an annual average return of 8.6 per cent could be earned on the money invested. In the worst case, the annual return was 3.3 per cent, in the best case 15.2 per cent.

ETFs can help you minimise your investment risk

In recent years, ETFs have been more successful worldwide than almost any other innovative financial instrument – both for professionals and for private investors. ETFs enable you to invest in hundreds of shares worldwide, in different sectors or currency areas at the same time. ETFs replicate the equity markets on which they are issued. By allocating (or spreading) investors’ money among different assets, ETFs enable investors to diversify their securities portfolio.

This reduces the risk of a loss, a risk an investor would enter into were they to invest all their money in just one share. Fluctuations in individual assets can be smoothed out: if the number of securities in the securities portfolio rises, the risk in the overall portfolio falls.

From just €50.00 a month, ETFs are a worthwhile investment. Pension provision is becoming ever more important. But Germans continue to invest too little in shares or ETFs, primarily because they do not know anything about this investment format.

Access to the world of stock markets – financial education must become part of general education

Deutsche Börse Group believes that financial knowledge impacts on growth, employment, and prosperity. It therefore supports financial education and the development of the equity culture through numerous initiatives:

- Each year, some 50,000 visitors, many school pupils among them, experience the goings-on in the exchange’s trading room live and free of charge.

- Around 100 times a day, various TV stations report to the entire world from the Frankfurt trading room – the only one of its kind in Europe.

- Börse Frankfurt offers knowledge of the financial market and a number of stock market products. On the Deutsche Börse web pages, you can find information such as fact sheets, videos, and webinars on capital-market-related topics.

Deutsche Börse Group

Headquartered in Frankfurt/Main, Deutsche Börse Group is one of the largest exchange organisations worldwide. It operates markets that provide integrity, transparency as well as security for investors wishing to invest capital and for issuers wishing to raise capital. On these markets, institutional traders buy and sell shares, derivatives, and other financial instruments in accordance with clear rules and under strict supervision.

Deutsche Börse Group is now more than just a trading venue or exchange – it is a provider of financial market infrastructure. Its business areas cover the entire financial market transaction process chain. This includes the provision of indices, data, and analytical solutions as well as admission, trading, and clearing. Additionally, it comprises services for funds, the settlement, and custody of financial instruments as well as the management of collateral and liquidity. As a technology company, the Group develops state-of-the-art IT solutions and offers IT systems all over the world.